Unfortunately, both homeowners and auto insurance rates are expected to continue rising. Therefore, it’s unlikely that homeowner and auto insurance rates will stop increasing in the near future. But that doesn’t mean you can’t lower your insurance costs.

The most serious reasons for the increases include the following:

- The increased number and severity of natural disasters such as extraordinary wildfire seasons

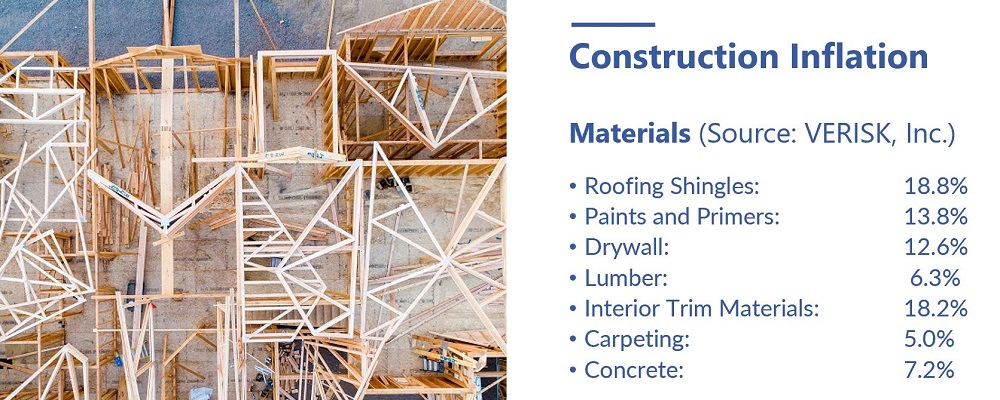

- Increasing construction material and labor costs – for example see image above

- Increased costs for auto repairs such as for the sensors and electronics in modern automobiles

- Increased migration to disaster-prone areas

- Prior insurance industry losses from resulting increased insurance claims

As a result, insurance companies are struggling to adapt and manage future risks, some by increasing rates, others by withdrawing entirely from market segments or whole markets.

What can you do to lower your Homeowner and Auto Insurance costs?

If you haven’t done these already consider:

- Checking that you have the right amount of insurance. Do you know the current cost of rebuilding your home or replacing your auto?

- Asking for discounts, for example through longevity with one insurance company, but also see this video blog: Insurance Discounts

- Bundling your homeowners and auto insurance policies to obtain an overall discount

- Increasing your deductible, the amount of money you have to pay toward a loss before your insurance company starts to pay a claim. The higher your deductible, the more money you can save on your premiums. If you can afford to raise your deductible, you may save a significant percentage.

- Shopping around for a new insurance provider – let us review your policy and suggest other potential ways to save or simply call us for a quote

- Increasing disaster preparedness and minimize claims through systematic maintenance, for instance is there a defensible zone around your home with no flammable materials, do you clean out your dryer vents each year (dryer vent fires account for 78% of appliance fires), are your sewer lines inspected/snaked annually (a $150 plumber visit may save you a $20,000 back up of a Toilet claim)

- HOAs have some other options too – see this blog post HOA Insurance Megatrends for more details.

Bottom line: call us for a coverage review and/or a quote on your homeowners and auto insurance. Farmers Insurance and other carriers we use have great coverage and prices!